Every now and then, I delve into the practical side of life. Its not always beauty related but will, I hope, be something useful. A while ago, I talked about credit cards and how not to use them and the ensuing discussion tells me we have a bunch of financially savvy ladies here – kudos everyone for not getting yourself into credit card debt, even though you can! 😉

But an underlying theme I got was how people seem to fear owning a credit card. Ladies, there’s no need to fear it, its just a piece of plastic after all! 😉 What we really need is self control. Once you get your self control in place, you can have 10 credit cards with a credit limit in the hundreds of thousands and still NOT be in credit card debt. In fact make your credit card work its butt off for you! 😉 So really, I’m telling you to use the bank, not let the bank use you 😉

Learn your credit card benefits and get maximum use of it

If you have a credit card, find out what its benefits are. Sometimes, if you purchase flight tickets online (and many of us do these days) most credit cards offer some form of insurance. So if you have problems with your flight e.g. flight delays or flight cancellations, you might be able to make a claim if you paid by credit card.

Another benefit I have on my card and make use of is the use of the Premium lounge at the airport. So when I do travel, I get a decent place to wait at the airport with food, drinks and free internet. Good wot? 😉 I hate the bank but I suck it up for this benefit 😛

Otherwise, look at the discounts on offer or cash rebates. Some credit cards offer better discounts than others for retail or dining. Some offer attractive cash rebates you can use towards off setting your bill. Some cards even allow you to use your rewards points at the point of sale so I’ve gotten “free” coffee and breakfast at Coffee Bean and Tea Leaf, or paid for stuff at Robinsons just by utilizing my rewards points at point of sale.

Don’t use more than 2 credit cards at any one time

This is mostly due to practicality. Here in Malaysia, we have an annual Government tax on each credit card and although RM50 a year doesn’t look like much, why spend that money unnecessarily? I keep my cards down to 2 and where possible, I try to ask for a waiver (unsuccessful thus far) or use my rewards points towards the government tax.

Another reason to not use more than 2 credit cards each time is to ensure you maximise your reward point or rebate collection. If you have 5 cards and spread out your spending across all the cards, you will find that your reward point collection will stagnate. However, if you use one or 2 cards only, its faster to accumulate points or rebates and easier to get benefits too.

Learn to read your statement and stretch your credit card payments

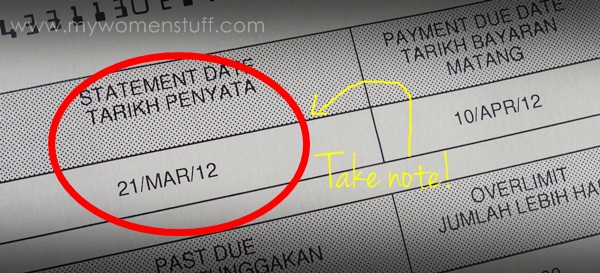

This one’s a slightly trickier one. I can sometimes charge an item to my card and not have to pay for nearly 2 months or about 2 pay checks. The secret lies in knowing how to read your credit card statement.

First, identify your statement issue date. This is the date when the bank issues your statement (not the date when payment is due) so that is the “cut off date” for you. Anything you charge immediately after your statement issue date goes into the next billing cycle. If you charge it just before your statement date, it will hit your card almost immediately thereby wiping out all benefits of credit.

Using the example above, if I charge something to be card on 20 March, it would be due on 10 April. If I had waited 2 days to 22 March, it would be billed on 21 April and I only have to pay by 10 May.

If you play it smart, you get to roll your cash for nearly 2 months or about 2 pay cycles, which can be very useful. Usually, you get something like 20 days from date of issue of statement to the date payment is due. Play it right and you’d not have to pay anything for nearly 2 months. But make sure you pay it all off when the time comes, else you’d be hit like a ton of bricks with interest.

Told you it will take a while to think about! 😉 But once you get the hang of it, its quite easy to manage your statement and I find this useful for when I plan to make a big purchase. I have the cash ready, but having an extra 20 days to pay really helps! Plus I love being able to game the system 😉

Do you have tips for making your credit card work for you? I’m still mostly a cash user and use my cards for larger transactions. Its still easier for me to control day to day spending using cash as opposed to a credit card and then fainting at the end of the month when I get the bill LOL! But when I do a large purchase, I plan wisely and try to maximise the benefits I can get from my card. My cards work for me – does yours? 😉

Paris B

I hardly take advantage of the credit card deals. Just because my Spendings are based on what I want and not where there is discount. I find it a chore to go through the promotional phamphlets that comes with the credit card.

So, I keep my frequent used cards down to 2. One is an Amex Krisflyer card. No lounge access but allows me to chock up quite a lot of miles. Another MasterCard I have is purely because some places don’t accept Amex.

I have HSBC and Citibank cards too as I can use them overseas to take advantage of card discounts if I ever chance upon them. And also to keep separate statements if I am on a work trip for subsequent claims. I don’t want to let my company’s admin staff see my personal expenses.

Haha I don’t bother scanning all the pamphlets either. Usually its only if I happen to be in store and I see the sticker or something by the cashier. Or a friend mentions a discount. Or if I’m really free and have nothing to do, I scan the pamphlets before I bin them 😛

So noisy here can’t read this post yet but I know is my dear credit card if pay early get penalty also

I played with my master card, to gain my cash rebate and that’s it! 🙂