I just got back from an expensive vacation but it was great fun and I ended up with some hefty purchases that if I had not saved up for beforehand, I don’t think I’d be able to afford!

But whilst its all good talking about saving money in separate bank accounts, or saving the small change the key idea is to actually have savings. And if you aren’t used to saving money, its not easy.

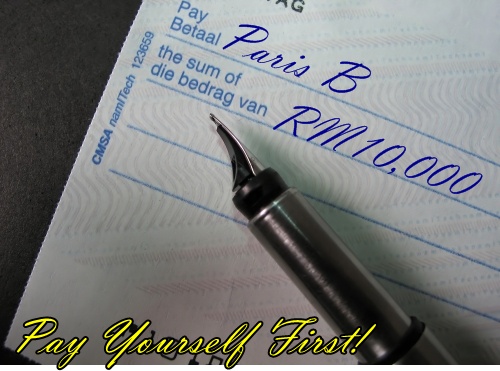

But starting is easy. Just write yourself a cheque every month for a preset amount, or transfer out the money into your separate savings account at the beginning of the month or when you get your pay.

Pay yourself first and then pay off your monthly bills and then when you have the spare change, have a little bit of fun. Saving money isn’t about suffering or depriving yourself from what you want.

Its saving up towards something bigger and better. And it starts with a cheque made out to yourself. Before you know it, the money adds up and voila! You can afford what you want 🙂

Of course, having a goal towards which to save is helpful. Saving with no end in sight can be pretty depressing 😛

Do you practice this already? I try to but its really applicable primarily for those with a regular monthly income. It makes it easier.

Paris B

Totally! I’m all for it. But like I’d explained to you, sometimes, saving is not such a good idea cos interests I earn get taxed and I got taxed a fair bit pre-home purchase. So, maybe I should just get the chanel and flip the finger at the taxman for a change 😛

Oh yeah lucky for us here, we don’t get taxed on our savings. That really sucks doesn’t it? There you are, saving for something nice and the taxman goes and takes a cut. Boo!

I’ll take a cheque every month if you’ll pay me! 🙂

I couldn’t afford you! 😛

^.^ @ Giddy Tigress.

Well, I found out that the more I save, the more “kiam siap” I become. When I was still at A Levels, I was like: I shall save for this and that. Now that I have the money from my internship, I’m like… eehhh… very expensive le… can I not buy it?

So yeah. Still can’t shell out the moolah to get the stuff I used to want.

That probably means you don’t “need” it, but just “want” it in which case, its perfectly alright to pass even after saving up. Its happened to me too. I usually save for big things like cars and houses and er… to indulge in my bag hobby.

actually i have been trying to do that 😛 but sometimes cc bill is so high that i can’t put any money aside! 🙁

Actually I’ve nearly stopped using my CC for lots of purchases. Some months, I don’t even have a CC bill to pay! Amazing right? 😉 I deal in cash so I know where my money goes.

w000t! i salute u! no cc to pay! i have cut down the use of it these 2 months, only for petrol. i was proud of myself through out the whole sept coz i only swiped once for petrol…till i signed a facial package then my proudness collapsed!

easier said than done! but once you have the habit, it’s quite easy actually LOL

speaking of which, i need to fork out mine soon when my pay comes out! 😀

Definitely easier said than done but as you say, its a habit. Once you get into the habit, its easy to continue 😀 Good on ya for saving!

I save! I’m still a student so I save out of my pocket money! Half of it goes to my bank account and the other half goes to my wallet. Then I start working my budget from my wallet, I start deducting necessities like phone credit and put aside an amount for that thing I’m saving up for, and then divide the leftovers for lunches (ie, how much I can spend per lunch), But i don’t usually eat lunch in college, I bring food there. And sometimes I go straight home cause my classes for the day ends at 11.45 but then again there are days where I cut myself some slack and eat lunch cause it feels good. Then before you know it, I can afford a weekly movie! =D

I love how methodical you are! Are you a finance student? Because that would make sense hehe… It also makes you appreciate the odd treat more doesn’t it? Its great that you are starting early and before you know it, you’ll have your dream item!

ehehe no….in fact, I want to become a dietitian XD I wanted to learn accountings when I was in secondary school…but in the end I ended up sleeping through it all and not taking it for SPM =S

And yes it does! It makes you treat eating out as a TREAT treat! =D and yes, I do hope I can achieve that thingy-ma-jig that I want…sadly because a student’s pocket money is limited, I don’t save much =P I wanted to get a part time job but the parents will not let as they want me to focus on my studies O.o

Ooh a dietitian! I hope you achieve your dream 😀 And your parents are absolutely right. Focus on your studies for now. There’s lots of time to enter the working world and to earn money – and you’d need good grades to get your foot into the door of a good job 😉 Take it from someone who knows 😉

hahaha, yes. I shall take thy advice milady ^^ I do hope I can land a good job though =S Since my aunt said it’s hard to get jobs as a dietitian nowadays XD

PB! Same with you! I do the same, I have 2 online bank accounts and each time I get paid, I transfer a specific amount to the “NO TOUCH” account and save!!!! 🙂

Same here. That helps a lot. I have an auto transfer every month.

Its a good habit to have 🙂 Yay for saving!

I used to do the same thing – and still do when I have the chance 😀 In fact, where possible I put them into time deposits so I don’t touch them at all 😀

Its definitely a good practice and especially useful to ppl like me; I’ve recently booked 3 hols trips so savings is a MUST! 🙂

Those frequent sales here aren’t helping though haha.

I’ve found I’m using my credit card a lot less when I’m in SG, plus only making a trip to the ATM only every couple of weeks or so (especially when rent is due). To my surprise my savings have actually gone up quite a bit! 😀 at least, that was until the hefty 5-figure bill on my apartment renovations came in and it got wiped out overnight… :s

that said, it’s still a lot better than when I used to live paycheck to paycheck – some pple would do well to take your money advice rather than sell off their possessions last minute. 😉

oh, and that tin of 50cent and SG$1 coins I started collecting in May? I just counted it – came up to SG$80+…not bad for spare change.. 😀